What I Learned Fixing Up My House—The Hard Way

So I decided to renovate my home, thinking it’d be a quick upgrade with big payoff. Instead, I nearly blew my budget, stressed nonstop, and learned the hard way how risky renovations can be. This isn’t just about paint and flooring—it’s about protecting your money. If you’re planning a remodel, you need to know the hidden risks and how to dodge them before the first hammer swings. What started as a dream project became a financial wake-up call. I underestimated costs, overestimated timelines, and overlooked the emotional toll. But through trial, error, and more than a few sleepless nights, I discovered principles that could save others from the same fate. This is not a story of perfect results, but of hard-earned wisdom.

The Dream vs. The Reality of Home Renovation

Many homeowners begin a renovation with a vision of transformation—gleaming countertops, open-concept living, natural light flooding through new windows. These images, often drawn from magazines or social media, promise beauty and value in equal measure. The assumption is simple: invest now, reap rewards later. But reality rarely follows such a clean script. What feels like a straightforward upgrade can quickly spiral into a complex, costly, and emotionally draining journey. The gap between expectation and experience is not just wide—it’s often unacknowledged until it’s too late.

Take the case of a mid-century home in a growing suburban neighborhood. The owners envisioned a modern kitchen that would serve as the heart of the home. They researched layouts, selected premium finishes, and secured quotes from three contractors. Everything seemed aligned. Yet once demolition began, they discovered outdated wiring, corroded plumbing, and subfloor damage—all hidden beneath intact surfaces. What was supposed to be a 10-week, mid-range renovation turned into a 22-week overhaul with costs nearly doubling. The dream remained, but the path to it had changed completely.

This kind of scenario is more common than most realize. Optimism is a natural starting point, but it can blind even the most careful planners. People tend to focus on visible changes—new cabinets, updated lighting—while overlooking structural integrity, code compliance, or utility systems. These elements don’t contribute to aesthetic appeal, but they are foundational to safety and long-term value. When they fail, they don’t just require fixes—they demand full reevaluations of scope and budget. The emotional toll compounds as timelines stretch and stress accumulates.

The key lesson is not to abandon renovation dreams, but to ground them in realism. A successful project starts not with paint swatches or tile samples, but with a mindset shift. It requires acknowledging that homes, especially older ones, carry decades of modifications, shortcuts, and wear. What looks sound may conceal vulnerabilities. Planning must include not just what you want to change, but what you might be forced to change. That means building flexibility into both schedule and finances from day one. The dream remains valid, but it must be pursued with eyes wide open.

Hidden Financial Risks Lurking in Every Project

Beneath the surface of every renovation lies a network of potential financial pitfalls. These are not always obvious at the outset, and many homeowners don’t discover them until invoices arrive or work stalls. Unlike purchasing a car or appliance, where price and features are clearly defined, home remodeling involves variables that can shift without warning. These hidden risks are not anomalies—they are predictable parts of the process, and failing to account for them is one of the most common financial mistakes.

One of the most frequent surprises is structural or system-related issues. Homes built before the 1980s often contain materials and methods no longer in use—knob-and-tube wiring, lead pipes, asbestos insulation. While these may have functioned for decades, they now pose safety and compliance concerns. Removing or upgrading them is not optional; it’s mandated by code. And the cost can be substantial. A minor bathroom update can suddenly require full electrical rewiring if the existing system doesn’t meet current standards. These discoveries are rarely caught in initial inspections, especially if access is limited behind walls or under flooring.

Permit delays are another silent budget killer. Local building departments require approvals for structural, electrical, and plumbing changes. But processing times vary widely, and applications can be rejected for missing documentation or noncompliance with zoning rules. One homeowner in a coastal town planned a second-story addition only to find that height restrictions had recently been tightened. The redesign alone added three weeks and thousands in architect fees before construction even began. Another faced a six-week hold because their permit application lacked an energy compliance form—an easily overlooked detail with major consequences.

Material price volatility is another underestimated factor. Over the past decade, global supply chains have made home improvement materials subject to market swings. Lumber prices, for example, have fluctuated by over 100% within single calendar years. A contractor quoting prices in January may face 30% higher costs by April due to supplier shortages or transportation issues. When contracts don’t account for these shifts, homeowners are often left covering the difference. Similarly, specialty finishes—imported tiles, custom cabinetry—can face long lead times or discontinuation, forcing costly substitutions.

Then there’s the human factor: contractor reliability. Not all professionals deliver as promised. Some may lack the capacity to manage unexpected changes, while others cut corners to maintain margins. A verbal agreement about timeline or scope can lead to disputes when expectations diverge. One family learned this the hard way when their contractor vanished for two weeks during a critical phase, delaying the entire project and incurring additional living expenses. These risks aren’t signs of failure—they’re part of the landscape. Recognizing them early allows for better planning and protection.

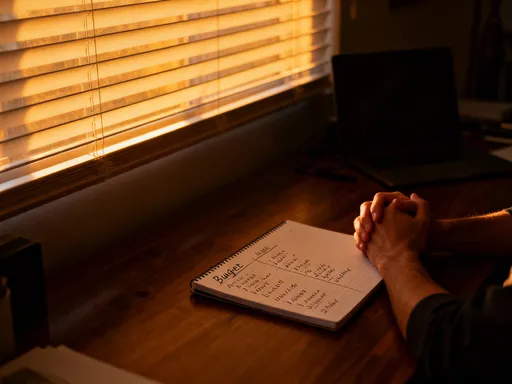

Why Your Budget Is Probably Too Thin (And How to Fix It)

Most renovation budgets fail not because people spend recklessly, but because they plan too narrowly. The typical approach is to list expected costs—labor, materials, permits—and add a small buffer. But this buffer is often inadequate, based more on hope than experience. The truth is, nearly every renovation encounters unforeseen expenses. The difference between success and financial strain often comes down to whether those surprises were anticipated and funded.

A well-structured budget doesn’t just cover known costs—it prepares for the unknown. This means setting aside a meaningful reserve, not a token amount. While exact figures vary, the principle remains: a portion of total funds should be held back specifically for contingencies. This isn’t wasted money; it’s insurance against disruption. When unexpected repairs arise—say, foundation cracking or HVAC failure—having accessible funds prevents panic-driven decisions like high-interest borrowing or project abandonment.

Staged funding is another smart strategy. Instead of releasing all funds upfront, homeowners can align payments with project milestones. For example, 20% at signing, 30% after demolition and inspection, 30% upon framing and rough-ins, and the remainder after final walkthrough. This approach maintains leverage, ensures accountability, and preserves cash flow. It also creates natural checkpoints to assess quality and progress. If issues emerge at a milestone, work can be paused before more money is spent.

Prioritization is equally important. Not all upgrades deliver equal value. A luxury soaking tub may bring personal joy, but it won’t recoup its cost at resale. On the other hand, energy-efficient windows or a functional kitchen layout offer broader appeal and stronger return. Smart budgeting means distinguishing between wants and needs, and funding essentials first. One family avoided financial disaster by postponing a backyard deck to focus on roof repair and insulation—upgrades that improved comfort and reduced utility bills immediately.

The contrast between prepared and unprepared homeowners is stark. One couple maintained a dedicated renovation account, kept lines of communication open with their contractor, and adjusted plans calmly when plumbing issues arose. They finished on time and within a revised but manageable budget. Another family, eager to impress relatives, charged unexpected costs to credit cards. Within months, they faced double-digit interest rates and strained relationships. The lesson is clear: budgeting isn’t just about numbers—it’s about discipline, foresight, and emotional control.

Choosing the Right Help—Without Getting Played

Selecting a contractor is one of the most consequential decisions in any renovation. It’s not just about skill or price—it’s about trust, clarity, and accountability. Yet many homeowners make this choice based on referrals, gut feeling, or the lowest bid. While these factors matter, they’re not enough. A poorly vetted professional can derail a project, inflate costs, and create legal or safety risks. The goal isn’t just to find someone who can do the work, but someone who will do it right—with integrity and transparency.

Vetting begins with verification. Licensed contractors are required to meet minimum standards of knowledge and financial responsibility. Licensing rules vary by state, but a valid license indicates that the professional has passed exams, carries insurance, and is subject to oversight. Checking with the local licensing board can reveal complaints, suspensions, or expired credentials. Equally important is proof of liability and workers’ compensation insurance. Without it, homeowners could be liable for on-site injuries—a single accident could result in tens of thousands in medical or legal costs.

References matter, but they must be used wisely. A list of past clients is only useful if you actually call them. Ask specific questions: Did the project finish on time? Were there unexpected costs? How were problems handled? One homeowner discovered that a contractor’s glowing online reviews were contradicted by a former client who described shoddy work and ignored calls. That warning prevented a costly mistake.

The contract itself is the cornerstone of protection. It should detail every aspect of the project: scope of work, materials, timeline, payment schedule, and warranty. Vague language like “complete kitchen remodel” invites disputes. Instead, it should specify cabinet types, appliance models, finish grades, and demolition boundaries. A well-drafted contract also includes clauses for change orders—formal agreements for any modifications, with cost and timeline adjustments. Verbal promises mean nothing without written documentation.

Cash-only deals are a major red flag. While they may come with a discount, they eliminate paper trails and accountability. Without receipts or bank records, it’s nearly impossible to dispute poor work or file insurance claims. Similarly, contractors who resist signing contracts or demand full payment upfront are signaling risk. Transparency should be mutual: homeowners should expect clarity, and professionals should welcome it. The right contractor doesn’t just want the job—they want a fair, documented partnership.

Financing Renovations Without Wrecking Your Future

How you pay for a renovation can have long-term consequences far beyond the project itself. Many homeowners turn to financing because the upfront cost is too high, and that’s understandable. But the method of financing matters deeply. Using high-interest credit cards, tapping home equity without caution, or taking on personal loans can create burdens that last years. The danger isn’t just in borrowing—it’s in borrowing without a clear repayment strategy.

Home Equity Lines of Credit (HELOCs) are popular because they offer flexible access to funds at relatively low interest rates. They’re tied to the home’s value, so they feel like “safe” debt. But they’re still secured loans—meaning the house is collateral. If payments are missed, foreclosure becomes a risk. And because HELOCs often have variable rates, monthly payments can rise unexpectedly when interest rates climb. A homeowner who locks in a $40,000 line at 5% could see that jump to 8% or more within two years, dramatically increasing the cost.

Cash-out refinancing is another option, replacing the existing mortgage with a larger one and taking the difference in cash. It can consolidate debt and fund renovations in one move. But it resets the mortgage term, potentially extending the payoff period and increasing total interest paid. A 15-year homeowner who refinances may end up with a new 30-year loan, losing years of equity progress. This trade-off must be weighed carefully.

Personal loans offer fixed rates and unsecured terms, but they often come with higher interest than home-secured options. They’re best for smaller projects or when home equity isn’t available. Credit cards should be used with extreme caution. While 0% intro rate offers seem attractive, they typically last 12 to 18 months. If the balance isn’t paid in full, the rate can jump to 20% or more. One homeowner charged $18,000 to a card, assuming they’d pay it off quickly. A job loss delayed repayment, and within a year, interest added over $2,000.

The smarter approach is alignment: matching the financing method to the project’s value and timeline. Long-term improvements—like energy-efficient windows or structural repairs—justify longer-term financing. Short-term cosmetic updates should be funded with cash or short-term loans. Emotional spending—choosing finishes or features beyond budget because “it’s now or never”—leads to regret. Financing should serve the plan, not drive it.

Protecting Your Investment with Smart Risk Controls

Renovating a home is not just a financial transaction—it’s an investment in shelter, comfort, and long-term stability. Like any investment, it requires protection. Smart homeowners don’t just spend money; they build safeguards into the process. These risk controls aren’t signs of distrust—they’re tools of responsibility. They ensure that every dollar spent delivers value, and that problems are caught before they become crises.

Detailed contracts, as mentioned earlier, are the first line of defense. But they must be enforced. Milestone-based payments give homeowners leverage to inspect work before releasing funds. If tile installation is uneven or framing is incomplete, payment can be withheld until corrections are made. This isn’t adversarial—it’s accountability. One couple paused a project when they noticed water stains on newly installed drywall. Inspection revealed a plumbing leak. By stopping work, they avoided $15,000 in mold remediation and structural repair.

Third-party inspections are another powerful tool. While building departments conduct code checks, they don’t assess quality or workmanship. Hiring an independent inspector at key stages—after rough-ins, before drywall, at final completion—provides an extra layer of oversight. These professionals spot issues contractors might overlook or downplay. One homeowner discovered that electrical outlets were improperly grounded, a safety hazard that could have led to fire or equipment damage.

Insurance review is often neglected. Standard homeowner policies may not cover renovation-related risks like theft of materials, damage during construction, or liability for workers. A renovation endorsement or builder’s risk policy can fill these gaps. One family assumed their policy covered their kitchen remodel—only to learn, after a fire, that temporary structures and stored materials were excluded. The loss wasn’t total, but it was significant.

Documentation is the silent guardian of every successful project. Keeping records of contracts, change orders, payments, permits, and correspondence creates a clear trail. If disputes arise, this paper trail is essential. Photos taken at each stage provide visual proof of progress and condition. One homeowner used dated photos to dispute a contractor’s claim that flooring damage occurred after installation. The evidence showed the dents were present before delivery—saving thousands in replacement costs.

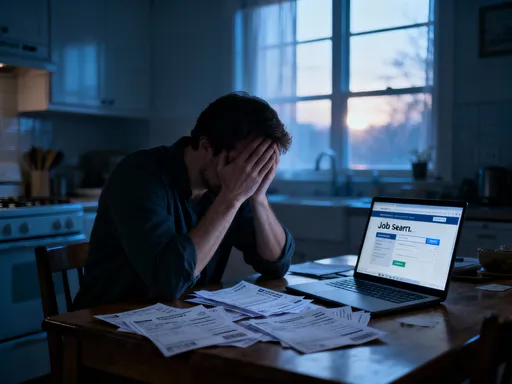

When to Pivot—Knowing When to Stop or Scale Back

One of the hardest financial skills in renovation is knowing when to change course. Pride, momentum, and emotional investment can make it difficult to admit that a plan isn’t working. But flexibility isn’t failure—it’s wisdom. The ability to pause, reassess, and adjust is what separates sustainable projects from financial disasters.

Warning signs are often visible long before crisis hits. Costs rising faster than reserves, contractors missing deadlines repeatedly, family stress increasing—these are not just inconveniences. They’re signals. One homeowner realized they were borrowing from retirement accounts to cover overruns. That moment of clarity led them to halt work, reevaluate priorities, and return six months later with a leaner, better-funded plan. They finished the project successfully—and without long-term damage.

Scaling back doesn’t mean giving up. It means choosing what matters most. A full basement remodel might be postponed in favor of finishing just one room for immediate use. A dream kitchen might be implemented in phases—cabinets now, appliances later. This approach preserves financial health and reduces pressure. It also allows time to refine decisions, avoid impulse upgrades, and secure better pricing.

Market conditions can also influence timing. In a cooling real estate market, major renovations may not yield strong returns. Waiting for better conditions can be a strategic choice. One family paused their exterior upgrade when appraisals in their area plateaued. They used the time to pay down debt and rebuild savings. When the market improved, they proceeded with confidence and greater resources.

The emotional difficulty of pivoting is real. Admitting that a plan needs change can feel like defeat. But the real victory is in protecting your home, your savings, and your peace of mind. Finishing isn’t always winning. Sometimes, the strongest move is to stop, regroup, and come back smarter.

Renovate Smarter, Not Harder

Home renovation isn’t just about transforming a space—it’s about managing risk, emotions, and long-term goals. The real return isn’t just in square footage, but in confidence and control. By planning for the worst, protecting every dollar, and staying ready to adapt, you don’t just upgrade your house—you strengthen your entire financial foundation. Every decision, from contractor selection to financing method, shapes not just the home, but the household’s stability. The lessons learned the hard way don’t have to be repeated. With foresight, discipline, and the right safeguards, any homeowner can renovate with purpose—and peace of mind.